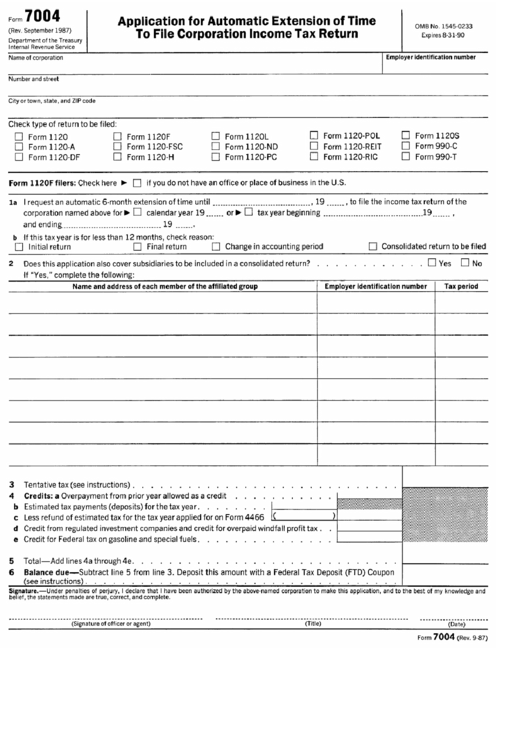

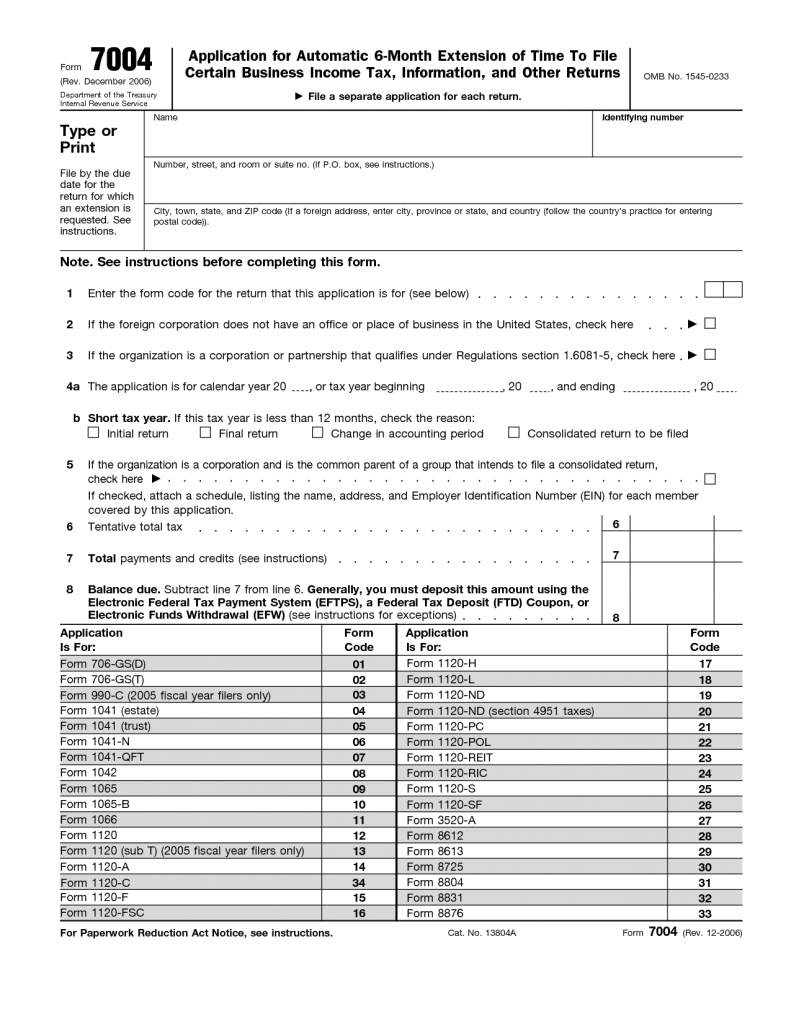

We 15 Electing Large Partnerships: File Form 1065-B calendar year return. filing for an automatic six-month extension (Form 7004), and paying any tax due. File Form 7004 for extension (see instructions). Employers: Providing 2016 Form W-2 to employees reporting income tax. We 15 Partnerships: File Form 1065 for the calendar year and furnish a copy of Sch. For automatic 6-month extension, file Form 7004 and deposit estimated tax. All other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use Form 7004 to request an extension of time to file income tax.

File Form 2553 to elect S Corp status beginning with calendar year 2017. We 15 S Corps: File Form 1120S for calendar year and pay any tax due. Th 2 Applicable Large Employers provide Forms 1095-C to full time employees For all other providers of Minimum Essential Coverage, provide Forms 1095-B to responsible individuals.

However, you have until Apr 18 to file if you paid your 2016 estimated tax payments by Jan 17, 2017. Deadline for corporate tax returns (Forms 1120, 1120A, and 1120S) for the year 2016, or to request automatic 6-month extension of time to file (Form 7004). We 1 Farmers and fishermen: File Form 1040 and pay any tax due.

0 kommentar(er)

0 kommentar(er)